Ended up losing over $600 on 20 trades, about 10 trades too many. Also had some big stop losses like over $500 which is contrary to cutting losses quick strategy. I failed to realize the market was in uptrend mode and tried playing FAZ and SRS for reversals which is more difficult to accomplish than to trade with the trend via FAS. I did manage to nail FAS at the very end of the day for $584 but by then it was too little too late.

Back to the drawing board. Must cut losses quick and small. Trade with the trend. Don't over trade, wait for setups.

Wednesday, March 18, 2009

Monday, March 16, 2009

Helluva day

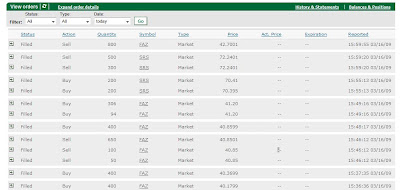

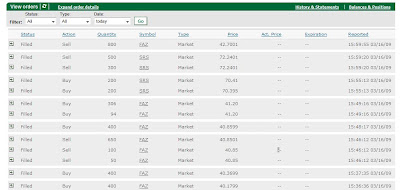

Reality returned to the slotmarket today. After going up 4 straight days last week I was just waiting for that correction and boy did it ever correct. In just the last 2 hours the DIJA fell 176 pts or 2.38% from the high of the day pretty much straight down. I had ten trades, most of them were 800 FAZ and only lost on 4. I was able to keep the losses small: $60, 108, 56, 84. But had to endure one draw down of over 1K before FAZ turned around and the rest was history. Winners: $168, 1552, 372, 460, 1336 for a total of $3580 trading FAZ.

The real miracle was the recovery of my SRS debacle from last Wednesday. I had to suffer the pain of a nearly $4k draw down last week but I had faith that the bottom isn't in yet. I bought 400 more @ 70.40 and sold all 800 @ 72.24 for a profit of $1451. Total take on the day $5030 which is a new one day record.

These triple inverse ETFs are not meant for holding long term or even overnight. I just got damn lucky holding them but that was not by design but purely accidental.

I will not hold them overnight in the future as they could gap on the open by $10 or more either way up or down. It is just way too risky in the current environment.

Here's the screen shot of the last few trades:

The real miracle was the recovery of my SRS debacle from last Wednesday. I had to suffer the pain of a nearly $4k draw down last week but I had faith that the bottom isn't in yet. I bought 400 more @ 70.40 and sold all 800 @ 72.24 for a profit of $1451. Total take on the day $5030 which is a new one day record.

These triple inverse ETFs are not meant for holding long term or even overnight. I just got damn lucky holding them but that was not by design but purely accidental.

I will not hold them overnight in the future as they could gap on the open by $10 or more either way up or down. It is just way too risky in the current environment.

Here's the screen shot of the last few trades:

Friday, March 13, 2009

The shit has hit the fan

I pulled the sell order last night, planning on getting up before the open so I could manage the trade. Well, I didn't get up until half an hour after the open and by then SRS was in the tank already. I didn't want to sell and book a sucky loss so now I'm in the house of pain, big time. But I have full faith that it will turn out ok cuz the experts at http://www.isthisthebottom.com/ with their proven algorithm and time tested wave counts always has the precise answer to the question "Is the bottom in yet?"

Wednesday, March 11, 2009

Messed up

Got back from the morning job in time to buy SRS 68.94 as it started ramping up. I went to put in a sell order but didn't notice it was still in buy mode and mistakenly bought another 200. So, now I got a sell order to execute at the open. I'm going to have to do a lot of praying tonight. Good sign was that the market close very weak, so I'm hoping the weakness will continue overnight.

Sunday, March 8, 2009

Was it luck again

Friday right before the open I noticed SRS was outperforming SKF so I decided to trade it instead of SKF. At 9:34 I bought 100 @ 98.83 and immediately suffered some pain as it reversed and got as low as 96.17. On the 3 minute chart I can see a Three Inside Up pattern forming and as it broke over the opening 30 minute high I bought another 100 @ 98.91. For the next 15 minutes it went straight up and I moved my trailing stop up the whole way and got stopped out at 106.24 at the time of 10:19:55 for a gain of 7.37. About the only mistake I made was not moving the trailing stop faster and tighter and maybe left a buck on the table but overall pretty happy with how I handled the trade.

Sure, I got lucky again, I mean how often does something go straight up 15 minutes without a single red candle. Then again, you do have to put on the trade, so it wasn't all luck.

Here's the 3 minute chart, click on image to enlarge

Sure, I got lucky again, I mean how often does something go straight up 15 minutes without a single red candle. Then again, you do have to put on the trade, so it wasn't all luck.

Here's the 3 minute chart, click on image to enlarge

Thursday, March 5, 2009

I will stop overtrading

I've lost a chunk of change the last two days and I know why. I'm like a kid in a candy store with a pocket full of spending money or a recreational gambler with a bucket full of quarters in front of the slot machines in Vegas. I did 31 trades today on top of yesterday's 28. I'm friggin outa control. I need to slow everything down and I've got just the right medicine to cure my addiction.

I'm going to start trading 5 minute charts instead of 1 minute. That should only give me one or two setups a day per market. I'm going to blow out my account if I don't.

If I can't discipline myself to do this, I mine as well hand them the money at the door.

I'm going to start trading 5 minute charts instead of 1 minute. That should only give me one or two setups a day per market. I'm going to blow out my account if I don't.

If I can't discipline myself to do this, I mine as well hand them the money at the door.

Friday, February 27, 2009

I feel like the luckiest idiot alive today

Thursday I was trading FAZ most of the day and went long 400 @ 53.94 around 5 minutes before the close. I was looking to just squeeze a couple of hundred out of the trade and intended to sell my position before the close. At 15 seconds before the close I pushed the sell button to send the order in. Much to my horror the order never got executed. I think TDA's website was experiencing heavy traffic and my order just never got there in time before the close. So, there I was holding it overnight with no intentions of doing so. I was sweating it just a tad because you never can tell how the market will open with the Fed sticking their hand in things overnight.

This morning right before the open I could see that FAZ was going to open with a big gap up at around 64. That certainly put an early smile on my face which only lasted til the opening bell. The problem was that I also had SKF and SRS held from overnight.

Both of those were big losing positions but with the market opening with a big gap down, now were profitable trades. Once the market opened, all three immediately started falling and then were going up and down with huge swings. I couldn't decide what to do and to which one first like my brain was on system overload. The usual feelings of hope and greed were interfering with making the right decisions. As SKF was dropping I put in a stop at break even all the while hoping it would go back up so I could sell at a bigger profit but it never did and I was stopped out for no gain. This was after being up over $1300 at the open. Man did I feel like an idiot. Well, that was only the beginning of the idiot phase.

My SRS was in the green over $300 at the open after being in a gigantic hole the last couple of days. I was stuck holding it from a few days back when TDA had problems with one of their servers giving bad streaming quotes and locking up the real time charts. I couldn't place a stop order on it due to the quote problems. It was a profitable trade at one point but after I talked to TDA and found out about the bad server problem and how to circumvent the problem, SRS had dropped big and I didn't want to close the trade with a big loss. At one point today I was down over $3000 and man talk about feeling like an idiot. But the market tanked the last two hours and my SRS ended down only $956. I feel confident that this will eventfully be a profitable trade because CRE is going to get whacked this year. VNO just a few days ago reported a loss. With the economy worsening, this is just the beginning of more losses ahead. If this blue chip REIT is getting hit, the rest of the sector is sure to get whacked too.

Now the good news. I went to put in a sell order for FAZ but got an error message from TDA saying I don't have any shares in my posession. I was scratching my head wondering what they were talking about since I couldn't sell my position at the close yesterday, I was under the impression that I still own the shares. Upon checking the order status page I saw that my FAZ was sold 20 seconds after the open at $64 which was nearly the high of they day. Evidently my sell order was still in their system and was executed at the open. That $4000 profit was just a stroke of pure luck. This has got to be one of the craziest things that's ever happened to me playing in the slotmarket. Sure hope that is the sign that I'm going to have more good luck than bad this year.

This morning right before the open I could see that FAZ was going to open with a big gap up at around 64. That certainly put an early smile on my face which only lasted til the opening bell. The problem was that I also had SKF and SRS held from overnight.

Both of those were big losing positions but with the market opening with a big gap down, now were profitable trades. Once the market opened, all three immediately started falling and then were going up and down with huge swings. I couldn't decide what to do and to which one first like my brain was on system overload. The usual feelings of hope and greed were interfering with making the right decisions. As SKF was dropping I put in a stop at break even all the while hoping it would go back up so I could sell at a bigger profit but it never did and I was stopped out for no gain. This was after being up over $1300 at the open. Man did I feel like an idiot. Well, that was only the beginning of the idiot phase.

My SRS was in the green over $300 at the open after being in a gigantic hole the last couple of days. I was stuck holding it from a few days back when TDA had problems with one of their servers giving bad streaming quotes and locking up the real time charts. I couldn't place a stop order on it due to the quote problems. It was a profitable trade at one point but after I talked to TDA and found out about the bad server problem and how to circumvent the problem, SRS had dropped big and I didn't want to close the trade with a big loss. At one point today I was down over $3000 and man talk about feeling like an idiot. But the market tanked the last two hours and my SRS ended down only $956. I feel confident that this will eventfully be a profitable trade because CRE is going to get whacked this year. VNO just a few days ago reported a loss. With the economy worsening, this is just the beginning of more losses ahead. If this blue chip REIT is getting hit, the rest of the sector is sure to get whacked too.

Now the good news. I went to put in a sell order for FAZ but got an error message from TDA saying I don't have any shares in my posession. I was scratching my head wondering what they were talking about since I couldn't sell my position at the close yesterday, I was under the impression that I still own the shares. Upon checking the order status page I saw that my FAZ was sold 20 seconds after the open at $64 which was nearly the high of they day. Evidently my sell order was still in their system and was executed at the open. That $4000 profit was just a stroke of pure luck. This has got to be one of the craziest things that's ever happened to me playing in the slotmarket. Sure hope that is the sign that I'm going to have more good luck than bad this year.

Wednesday, February 18, 2009

Getting 6 Mbps for $17.50 from ATT

I called ATT and said my internet is just too slow and I think I'm going to try Comcast. She then transferred me to the retention dept. and I told that rep I'm thinking of going with Comcast cuz they're cheaper. She said ATT don't want to lose me and then looked up her system and lo and hold said they have a promo where I can get the 6 Mbps service at 50% off for next six months for $17.50 and I said done deal. It's only 2.50 more than what I'm paying now for basic 750 kbps. Man, can't wait to stream Netflix movies at 6 Mbps.

You just have to call them and ask. If you don't try you'll never get the discount. Don't be afraid to do this. Many people have done it and got it. They have a whole department (retention) set up just waiting for you to call so that they can give you that great deal. So what are you waiting for, pick up the phone and start saving some money and surf the net at lightning speed. Don't forget to set a reminder to call them in 6 months to get off that deal. Hopefully by then they will have another deal.

Update:

Seems like they will just give you 50% off of your current rate at your current level of service. I went over to a friends house to do this for her because she was unable to pull it off maybe due to her language problem and the rep asked what are you paying currently. I told her $25 and was offered 50% off for 6 months, $12.50 a month.

You just have to call them and ask. If you don't try you'll never get the discount. Don't be afraid to do this. Many people have done it and got it. They have a whole department (retention) set up just waiting for you to call so that they can give you that great deal. So what are you waiting for, pick up the phone and start saving some money and surf the net at lightning speed. Don't forget to set a reminder to call them in 6 months to get off that deal. Hopefully by then they will have another deal.

Update:

Seems like they will just give you 50% off of your current rate at your current level of service. I went over to a friends house to do this for her because she was unable to pull it off maybe due to her language problem and the rep asked what are you paying currently. I told her $25 and was offered 50% off for 6 months, $12.50 a month.

Monday, January 12, 2009

Jan. 12, 2009

Wednesday, January 7, 2009

Jan. 7, 2009

Today was the first trading day for me due to having to work last two days. By the time I logged on at 8:30 the market was down 160 pts. A quick check showed SKF was performing significantly better than SRS. There was some bad economic news out and I sensed today had a very good chance of big selloff.

First trade at 1 pm (est) SKF 107.08, looked like the market might crack prior low but failed and bailed at 106.50 for a small loss of 0.58 on 100 sh. At that point the dow looks like had support 8820 as it held twice there. At 1:42 the dow was heading down toward the 8820 area with momentum and I bought 100 SKF 107.18, after the dow cracked 8820 I added 100 more 107.59 and the final 100 at 108.08 for an average price of 107.72. I continued to move my stop up and was stopped out 110.21 for +2.49 on 300 shares.

The dow staged a brief rally and when it finally fizzeled and reversed I bought 200 at 109.98 and was stopped out at 111.24 for +1.26.

It was a very fine start in every aspect. I waited for the right entry point and exists weren't too terrible but maybe could've been a little better. I did not over trade, making only 3 traded.

Although the SKF and SRS isn't a perfect mirror image of the market indices it's close enough so that using the movement of the dow or sp500 to time the entry works quite well.

First trade at 1 pm (est) SKF 107.08, looked like the market might crack prior low but failed and bailed at 106.50 for a small loss of 0.58 on 100 sh. At that point the dow looks like had support 8820 as it held twice there. At 1:42 the dow was heading down toward the 8820 area with momentum and I bought 100 SKF 107.18, after the dow cracked 8820 I added 100 more 107.59 and the final 100 at 108.08 for an average price of 107.72. I continued to move my stop up and was stopped out 110.21 for +2.49 on 300 shares.

The dow staged a brief rally and when it finally fizzeled and reversed I bought 200 at 109.98 and was stopped out at 111.24 for +1.26.

It was a very fine start in every aspect. I waited for the right entry point and exists weren't too terrible but maybe could've been a little better. I did not over trade, making only 3 traded.

Although the SKF and SRS isn't a perfect mirror image of the market indices it's close enough so that using the movement of the dow or sp500 to time the entry works quite well.

Subscribe to:

Posts (Atom)