Ended up losing over $600 on 20 trades, about 10 trades too many. Also had some big stop losses like over $500 which is contrary to cutting losses quick strategy. I failed to realize the market was in uptrend mode and tried playing FAZ and SRS for reversals which is more difficult to accomplish than to trade with the trend via FAS. I did manage to nail FAS at the very end of the day for $584 but by then it was too little too late.

Back to the drawing board. Must cut losses quick and small. Trade with the trend. Don't over trade, wait for setups.

Wednesday, March 18, 2009

Monday, March 16, 2009

Helluva day

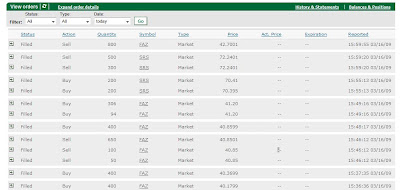

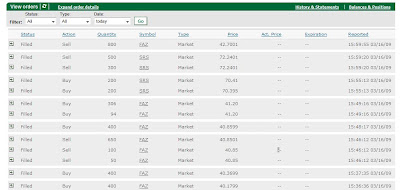

Reality returned to the slotmarket today. After going up 4 straight days last week I was just waiting for that correction and boy did it ever correct. In just the last 2 hours the DIJA fell 176 pts or 2.38% from the high of the day pretty much straight down. I had ten trades, most of them were 800 FAZ and only lost on 4. I was able to keep the losses small: $60, 108, 56, 84. But had to endure one draw down of over 1K before FAZ turned around and the rest was history. Winners: $168, 1552, 372, 460, 1336 for a total of $3580 trading FAZ.

The real miracle was the recovery of my SRS debacle from last Wednesday. I had to suffer the pain of a nearly $4k draw down last week but I had faith that the bottom isn't in yet. I bought 400 more @ 70.40 and sold all 800 @ 72.24 for a profit of $1451. Total take on the day $5030 which is a new one day record.

These triple inverse ETFs are not meant for holding long term or even overnight. I just got damn lucky holding them but that was not by design but purely accidental.

I will not hold them overnight in the future as they could gap on the open by $10 or more either way up or down. It is just way too risky in the current environment.

Here's the screen shot of the last few trades:

The real miracle was the recovery of my SRS debacle from last Wednesday. I had to suffer the pain of a nearly $4k draw down last week but I had faith that the bottom isn't in yet. I bought 400 more @ 70.40 and sold all 800 @ 72.24 for a profit of $1451. Total take on the day $5030 which is a new one day record.

These triple inverse ETFs are not meant for holding long term or even overnight. I just got damn lucky holding them but that was not by design but purely accidental.

I will not hold them overnight in the future as they could gap on the open by $10 or more either way up or down. It is just way too risky in the current environment.

Here's the screen shot of the last few trades:

Friday, March 13, 2009

The shit has hit the fan

I pulled the sell order last night, planning on getting up before the open so I could manage the trade. Well, I didn't get up until half an hour after the open and by then SRS was in the tank already. I didn't want to sell and book a sucky loss so now I'm in the house of pain, big time. But I have full faith that it will turn out ok cuz the experts at http://www.isthisthebottom.com/ with their proven algorithm and time tested wave counts always has the precise answer to the question "Is the bottom in yet?"

Wednesday, March 11, 2009

Messed up

Got back from the morning job in time to buy SRS 68.94 as it started ramping up. I went to put in a sell order but didn't notice it was still in buy mode and mistakenly bought another 200. So, now I got a sell order to execute at the open. I'm going to have to do a lot of praying tonight. Good sign was that the market close very weak, so I'm hoping the weakness will continue overnight.

Sunday, March 8, 2009

Was it luck again

Friday right before the open I noticed SRS was outperforming SKF so I decided to trade it instead of SKF. At 9:34 I bought 100 @ 98.83 and immediately suffered some pain as it reversed and got as low as 96.17. On the 3 minute chart I can see a Three Inside Up pattern forming and as it broke over the opening 30 minute high I bought another 100 @ 98.91. For the next 15 minutes it went straight up and I moved my trailing stop up the whole way and got stopped out at 106.24 at the time of 10:19:55 for a gain of 7.37. About the only mistake I made was not moving the trailing stop faster and tighter and maybe left a buck on the table but overall pretty happy with how I handled the trade.

Sure, I got lucky again, I mean how often does something go straight up 15 minutes without a single red candle. Then again, you do have to put on the trade, so it wasn't all luck.

Here's the 3 minute chart, click on image to enlarge

Sure, I got lucky again, I mean how often does something go straight up 15 minutes without a single red candle. Then again, you do have to put on the trade, so it wasn't all luck.

Here's the 3 minute chart, click on image to enlarge

Thursday, March 5, 2009

I will stop overtrading

I've lost a chunk of change the last two days and I know why. I'm like a kid in a candy store with a pocket full of spending money or a recreational gambler with a bucket full of quarters in front of the slot machines in Vegas. I did 31 trades today on top of yesterday's 28. I'm friggin outa control. I need to slow everything down and I've got just the right medicine to cure my addiction.

I'm going to start trading 5 minute charts instead of 1 minute. That should only give me one or two setups a day per market. I'm going to blow out my account if I don't.

If I can't discipline myself to do this, I mine as well hand them the money at the door.

I'm going to start trading 5 minute charts instead of 1 minute. That should only give me one or two setups a day per market. I'm going to blow out my account if I don't.

If I can't discipline myself to do this, I mine as well hand them the money at the door.

Subscribe to:

Posts (Atom)